Unlocking the Best SR22 Rates: A Comprehensive Guide

Find the most competitive SR22 insurance rates and get the coverage you need today.

Don't Get Lost in the Insurance Jungle

Navigate the confusing world of insurance with expert tips and tricks. Don’t get lost—get informed and empowered today!

Top 5 Tips to Navigate the Insurance Jungle

Navigating the insurance jungle can feel overwhelming, but with the right strategies, you can simplify your choices. First, understand your needs. Take the time to assess your personal situation, including assets, liabilities, and potential risks. Once you have a clear understanding, NerdWallet offers a helpful guide to the various types of insurance available, which can aid in deciding what policies are necessary for your lifestyle.

Next, research multiple providers to ensure you're getting the best coverage at the most competitive rates. Utilize comparison websites such as Policygenius, which allow you to view quotes from different insurers side-by-side. Don't forget the importance of reading customer reviews and checking the J.D. Power ratings for insurers, as this can provide valuable insights into customer satisfaction and claims processes. Following these steps can help you navigate through the complexities of finding the right insurance coverage.

Understanding the Different Types of Insurance: A Simplified Guide

When it comes to managing risks, understanding the different types of insurance is essential. Insurance can be categorized into several types based on the assets being protected and the specific needs of the policyholder. Here are some common categories:

- Health Insurance: Covers medical expenses for illnesses, injuries, and other health-related issues.

- Auto Insurance: Provides financial protection against physical damage or bodily injury resulting from traffic collisions.

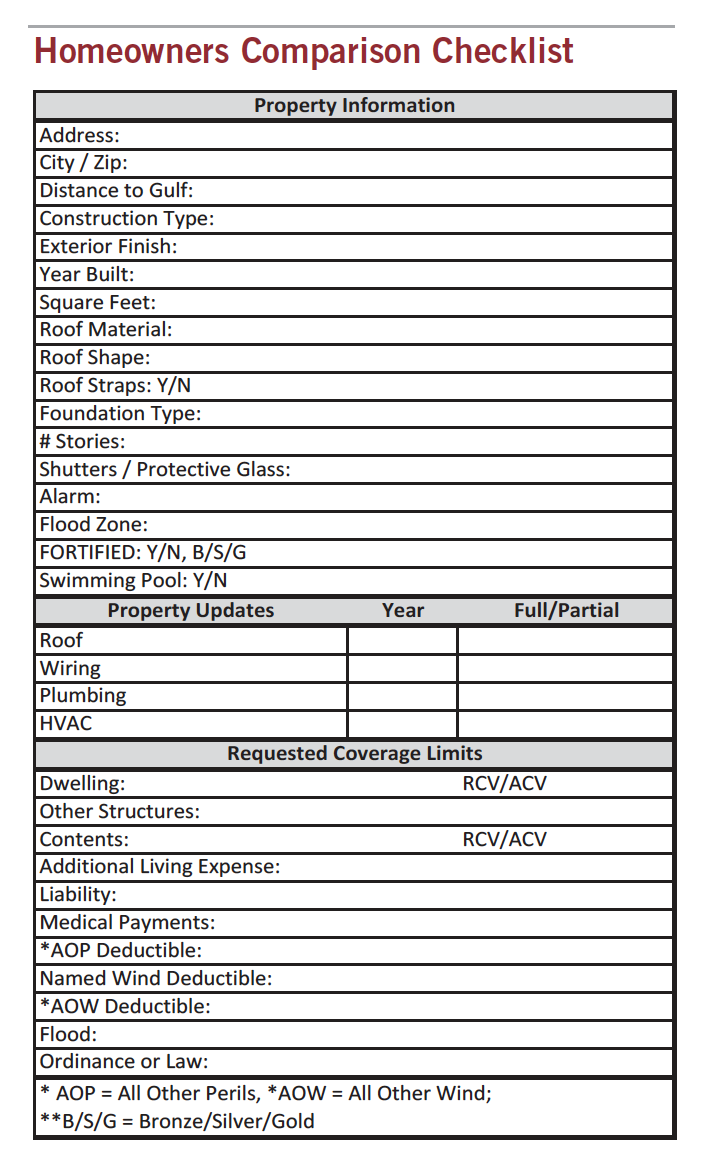

- Homeowners Insurance: Protects your home and personal property against disasters and theft.

Each type of insurance serves a unique purpose, so it's crucial to assess your individual needs to find the right coverage. For more comprehensive information on health insurance, check out this resource.

Moreover, life insurance and disability insurance are also important components of a well-rounded insurance portfolio. Life insurance provides financial support to your loved ones in the event of your untimely passing, while disability insurance replaces a portion of your income if you become unable to work due to illness or injury. Consider evaluating your options by visiting a reliable source like Investopedia.

Common Insurance Questions Answered: What You Need to Know

When it comes to understanding insurance, many people have common questions that can make the process less daunting. One of the most frequently asked questions is, What types of insurance do I need? Generally, individuals should consider a mix of health, auto, home, and life insurance, depending on their personal circumstances. For more detailed guidance, you can visit Investopedia to determine your specific insurance needs.

Another critical question often posed is, How do I choose the right insurance policy? It's essential to compare policies based on coverage options, deductibles, and premium costs. A well-structured approach is to create an ordered list of your priorities. Here’s a brief checklist to consider when evaluating insurance policies:

- Coverage Amount

- Premiums

- Deductibles

- Exclusions

- Customer Support

For an in-depth analysis on how to review various insurance policies, refer to Consumer Reports.