Unlocking the Best SR22 Rates: A Comprehensive Guide

Find the most competitive SR22 insurance rates and get the coverage you need today.

Insurance Comparison: Like Dating but for Policies!

Swipe right on the perfect insurance policy! Discover how comparing options can lead you to your ideal coverage match today!

Finding Your Perfect Policy Match: A Guide to Insurance Comparisons

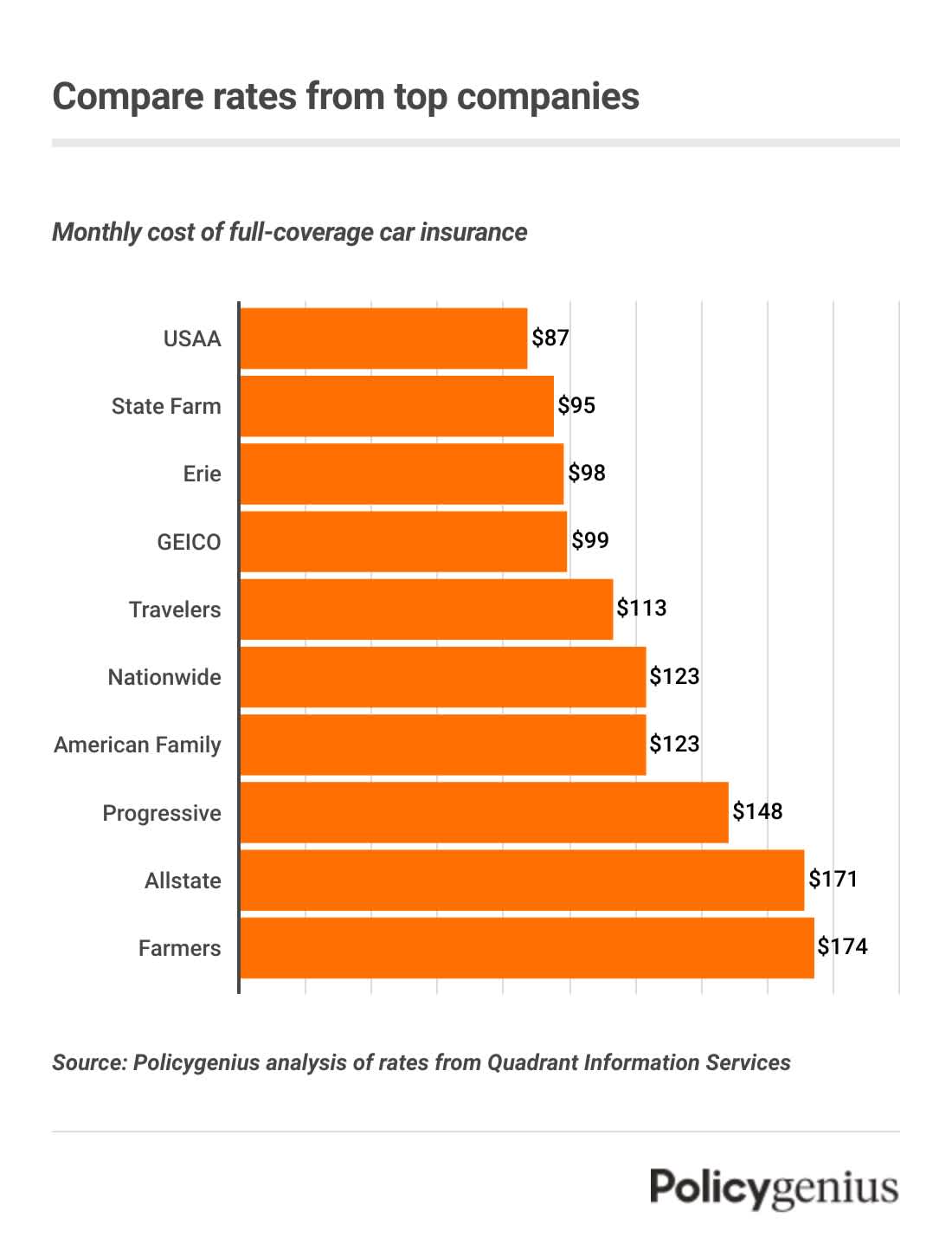

Choosing the right insurance policy can often feel like navigating a maze, but finding your perfect policy match is crucial for your financial security. Understanding the various types of insurance available, such as health, auto, or home insurance, is the first step in making informed comparisons. Begin by listing your specific needs and budget, and then utilize online tools and resources to compare multiple policies side by side. Websites like Policygenius and NerdWallet provide comprehensive comparisons that can simplify your decision-making process.

After identifying policy options that align with your needs, it's essential to scrutinize the terms and conditions of each. Look out for key factors such as premium costs, deductibles, and coverage limits. Additionally, consider reviews and ratings from current policyholders to gauge the provider's reliability and customer service. Websites like Consumer Reports offer valuable insights into the performance of different insurers. By conducting thorough research and utilizing these resources, you can confidently navigate the landscape of insurance comparisons and choose the right policy for you.

Swipe Right for Coverage: How to Choose the Best Insurance Policy

Choosing the best insurance policy can often feel overwhelming, akin to navigating the world of online dating. Just as you swipe right for compatibility, understanding your unique needs is crucial when selecting an insurance policy. Start by asking yourself essential questions: What types of coverage do I need? Am I looking for health, auto, or life insurance? Researching different policies can be simplified by leveraging online resources such as Investopedia that provide comparisons and insights on various options available in the market.

Once you've narrowed down your choices, it’s time to dig deeper. Look at factors such as premiums, deductibles, and coverage limits. Not all policies are created equal; some may offer more extensive coverage at a slightly higher price, while others might leave you exposed to risks. Don't hesitate to use tools like Policygenius to compare quotes and find the best deals tailored to your specific needs. Remember, the right policy should not only fit your budget but also provide you with the peace of mind you deserve.

Insurance Compatibility: What You Need to Know Before Committing to a Policy

When exploring insurance compatibility, it is crucial to understand how various policies align with your specific needs and circumstances. Before committing to a policy, you should evaluate the coverage options available and compare them with your personal or business requirements. Start by identifying your priorities, whether it be health, property, or vehicle insurance, and ensure the policy you choose provides sufficient coverage for those areas. Resources such as Insurance.com offer comprehensive comparisons that can help you see how different policies measure up.

One major aspect of insurance compatibility is the consideration of your financial situation and long-term goals. It’s essential to assess how the premiums fit into your budget and whether the coverage limits meet your future needs. Additionally, look into the reputation of the insurance provider by consulting reviews on platforms like Consumer Reports, as this can impact your overall satisfaction. Don't hesitate to reach out to insurance agents for personalized advice to ensure that you choose a policy that is not only compatible but also sustainable in the long run.