Unlocking the Best SR22 Rates: A Comprehensive Guide

Find the most competitive SR22 insurance rates and get the coverage you need today.

Protecting Paws and Wallets: Why Pet Insurance is a No-Brainer

Discover why pet insurance is a must for every pet parent! Protect your furry friends and your wallet from unexpected vet bills today.

Understanding Pet Insurance: What Every Pet Owner Should Know

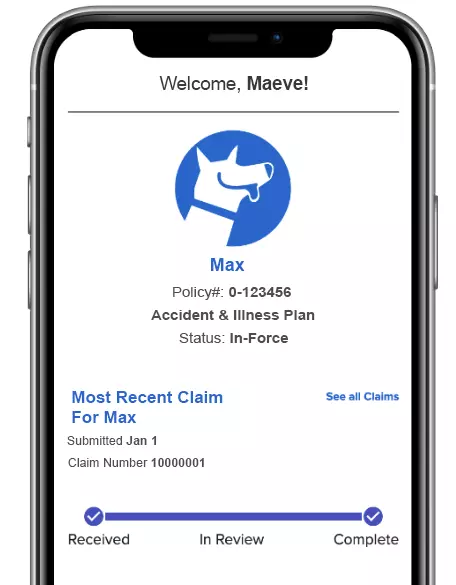

Understanding pet insurance is crucial for every pet owner, as it provides financial protection against unexpected veterinary expenses. Just like health insurance for humans, pet insurance helps cover the costs associated with accidents, illnesses, and preventive care. With various plans available, it's essential to understand the different types of coverage, such as accident-only plans, comprehensive plans, and wellness plans, to determine what best suits your pet's needs. For instance, an accident-only plan may be more affordable but could leave you exposed to higher costs if your pet develops a chronic illness.

Before choosing a policy, pet owners should consider factors like premium rates, deductibles, and coverage limits. It's also vital to read the fine print to understand any exclusions or waiting periods that may apply. Many providers offer customizable plans, allowing you to tailor your coverage based on your pet's age, breed, and specific health concerns. In addition, comparing different insurance providers and their customer reviews can help you make an informed decision, ensuring your furry friend receives the best possible care without breaking the bank.

Is Pet Insurance Worth It? Here’s What You Need to Consider

When considering whether pet insurance is worth it, it's essential to evaluate your pet's health, breed, and age. Some breeds are predisposed to specific health issues, which could lead to significant veterinary expenses over time. For instance, a strong history of genetic conditions in certain breeds could mean that investing in insurance is a wise decision. Additionally, consider your financial capacity to handle unexpected medical bills. Keeping track of your pet's health records and discussing potential risks with your veterinarian can provide valuable insights into whether insurance might be a cost-effective measure.

Another crucial factor in deciding on pet insurance is the type of coverage you require. Most policies offer options for accident-only coverage or comprehensive plans that include illness, accidents, and preventive care. Understanding these choices can help tailor the policy to your pet's specific needs. For example, if your pet is generally healthy, a basic plan may suffice, while a pet with chronic conditions may benefit from a more extensive policy. Additionally, always read the fine print to understand deductibles, co-pays, and any exclusions that could affect your overall costs.

Top 5 Reasons Pet Insurance Can Save You Money and Stress

When it comes to caring for our furry friends, unexpected medical expenses can arise at any time. Pet insurance is designed to help cover these costs, easing both your financial burden and mental stress. One of the primary reasons you should consider pet insurance is that it can save you a significant amount of money. Instead of draining your savings or using credit cards for emergency vet bills, a good pet insurance policy can ensure that you are only responsible for a fraction of the costs, allowing you to focus on what truly matters – your pet's health and happiness.

In addition to financial savings, pet insurance also provides peace of mind. Knowing that you are covered in case of an accident or unexpected illness helps reduce anxiety, allowing you to enjoy your pet's companionship more fully. Moreover, many insurance plans offer a wide range of coverage options, from routine care to major surgeries, making it easier for pet owners to find a plan that fits their needs and budget. In a world where the well-being of our pets can quickly lead to unforeseen challenges, having pet insurance can be a crucial safety net that minimizes both your stress and expenses.