Unlocking the Best SR22 Rates: A Comprehensive Guide

Find the most competitive SR22 insurance rates and get the coverage you need today.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover why term life insurance is the safety net everyone needs—protect your loved ones and secure your future today!

Understanding the Basics of Term Life Insurance: Is It Right for You?

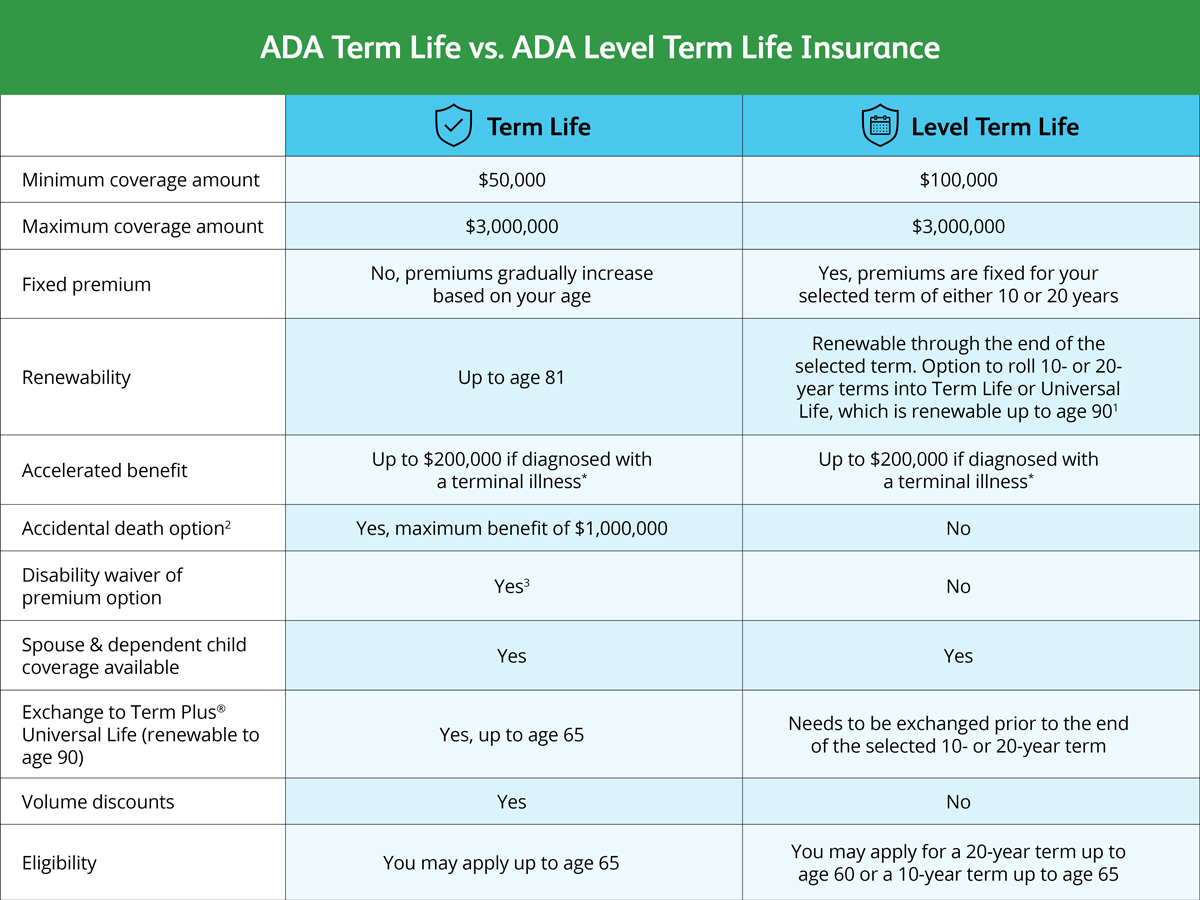

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. This means that if the insured person passes away within the term, the beneficiaries will receive a death benefit. It is simpler and often more affordable than other forms of life insurance, making it an appealing option for those seeking financial security for their loved ones. Factors to consider when determining if term life insurance is right for you include your current financial obligations, future goals, and family needs.

When evaluating whether to purchase a term life insurance policy, consider the following key points:

- Affordability: Term life insurance typically has lower premiums compared to whole life policies, making it a budget-friendly option.

- Future financial obligations: Assess how many years you need coverage based on your debts, mortgage, or education costs for your children.

- Flexibility: Some term policies allow you to convert to permanent coverage later if your needs change.

Top 5 Reasons Why Everyone Should Consider Term Life Insurance

Term life insurance is often seen as one of the most straightforward and affordable types of life insurance available. One of the primary reasons to consider it is the financial protection it offers to your loved ones. In the event of an untimely passing, a term life insurance policy can provide a lump sum payment that can be used to cover daily living expenses, pay off debts, or secure a child’s future education. Moreover, because term life insurance typically comes with lower premiums compared to whole life policies, it allows individuals to maintain their financial stability while ensuring their family is protected.

Another compelling reason to consider term life insurance is its flexibility. Policies can be customized to fit various needs—ranging from covering a specific period, such as the duration of a mortgage, to matching the financial support required during significant life milestones. This means you can choose a term length that aligns with your financial responsibilities, making it a strategic choice for those who have long-term obligations. In addition, many insurers offer conversion options, allowing you to change your term policy into a permanent one without needing a new medical exam, providing opportunities for long-term planning as your circumstances evolve.

How Does Term Life Insurance Work and What Can It Do for Your Family?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. It pays out a death benefit to the beneficiaries if the insured person passes away during the coverage term. This feature makes term life insurance an excellent choice for families looking for affordable protection against the unexpected loss of a loved one. Additionally, many term life policies allow the policyholder to convert to a permanent life insurance policy or renew the term upon expiration, offering flexibility for changing family needs over time.

One of the primary benefits of term life insurance is its ability to provide financial security for your family in case of your untimely demise. The death benefit can be used for various purposes, including paying off mortgages, settling debts, covering educational expenses, and ensuring your family's ongoing living expenses. This financial cushion can relieve the stress and burden on your loved ones during a difficult time. By choosing the right coverage amount and duration, you can effectively tailor the policy to suit your family's future needs and aspirations, making term life insurance a vital part of your overall financial planning.