Unlocking the Best SR22 Rates: A Comprehensive Guide

Find the most competitive SR22 insurance rates and get the coverage you need today.

Whole Life Insurance: Your Wallet's Best Kept Secret

Unlock the hidden benefits of whole life insurance—discover how it can boost your finances and protect your family's future today!

Unlocking the Benefits of Whole Life Insurance: What You Need to Know

Whole life insurance is a powerful financial tool that offers not only death benefits but also a savings component that grows over time. As you pay premiums, a portion is allocated to the cash value, which increases at a guaranteed rate. This unique feature allows policyholders to build wealth in a safe and predictable manner. By understanding the mechanics of whole life insurance, one can appreciate how it serves as a long-term investment strategy designed to provide both security for loved ones and financial growth.

One of the key benefits of whole life insurance is its ability to offer stability and predictability. Unlike term insurance, which only covers a certain period, whole life policies provide coverage for your entire life as long as premiums are paid. Additionally, the cash value can be borrowed against or withdrawn, offering liquidity in times of need. Here are some vital points to consider:

- Guaranteed death benefit for beneficiaries

- Tax-deferred growth of cash value

- Option to borrow against your policy

Whole Life Insurance vs. Term Life: Which Policy is Right for You?

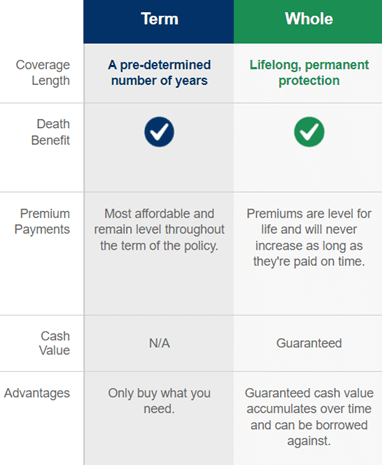

When considering life insurance, it's essential to understand the differences between whole life insurance and term life insurance. Whole life insurance provides lifelong coverage, ensuring that your beneficiaries receive a payout regardless of when you pass away. Additionally, whole life policies often accumulate cash value over time, which can be borrowed against or withdrawn if needed. On the other hand, term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. This type of policy is often more affordable, making it an attractive option for young families or those with temporary financial obligations.

Choosing the right policy depends on your individual needs and financial goals. If your priority is affordable premiums and temporary coverage, term life insurance might be the better choice. However, if you seek a policy that builds cash value and provides lifelong protection, whole life insurance may be more suitable. To make an informed decision, consider factors such as your age, health, and financial responsibilities. A thorough comparison of both options will enable you to determine which policy aligns best with your long-term vision of financial security for your loved ones.

Is Whole Life Insurance Worth It? Exploring the Financial Advantages

When contemplating whole life insurance, many individuals often wonder, Is it truly worth the investment? Whole life insurance not only provides a death benefit to beneficiaries but also includes a cash value component that grows over time. This cash value accumulates at a guaranteed rate, allowing policyholders to borrow against it or withdraw a portion if needed. Moreover, whole life insurance offers stability and predictability in an increasingly volatile financial landscape, making it a strong option for long-term financial planning.

One significant advantage of whole life insurance is its potential tax benefits. The cash value grows on a tax-deferred basis, meaning you won’t owe taxes on the growth until you withdraw from it. Additionally, the death benefit is typically paid out tax-free to beneficiaries, providing peace of mind. With its combination of death benefit, cash value growth, and tax advantages, many find that whole life insurance can be a valuable component of their financial strategy, offering lifelong coverage and an opportunity for wealth accumulation.