Unlocking the Best SR22 Rates: A Comprehensive Guide

Find the most competitive SR22 insurance rates and get the coverage you need today.

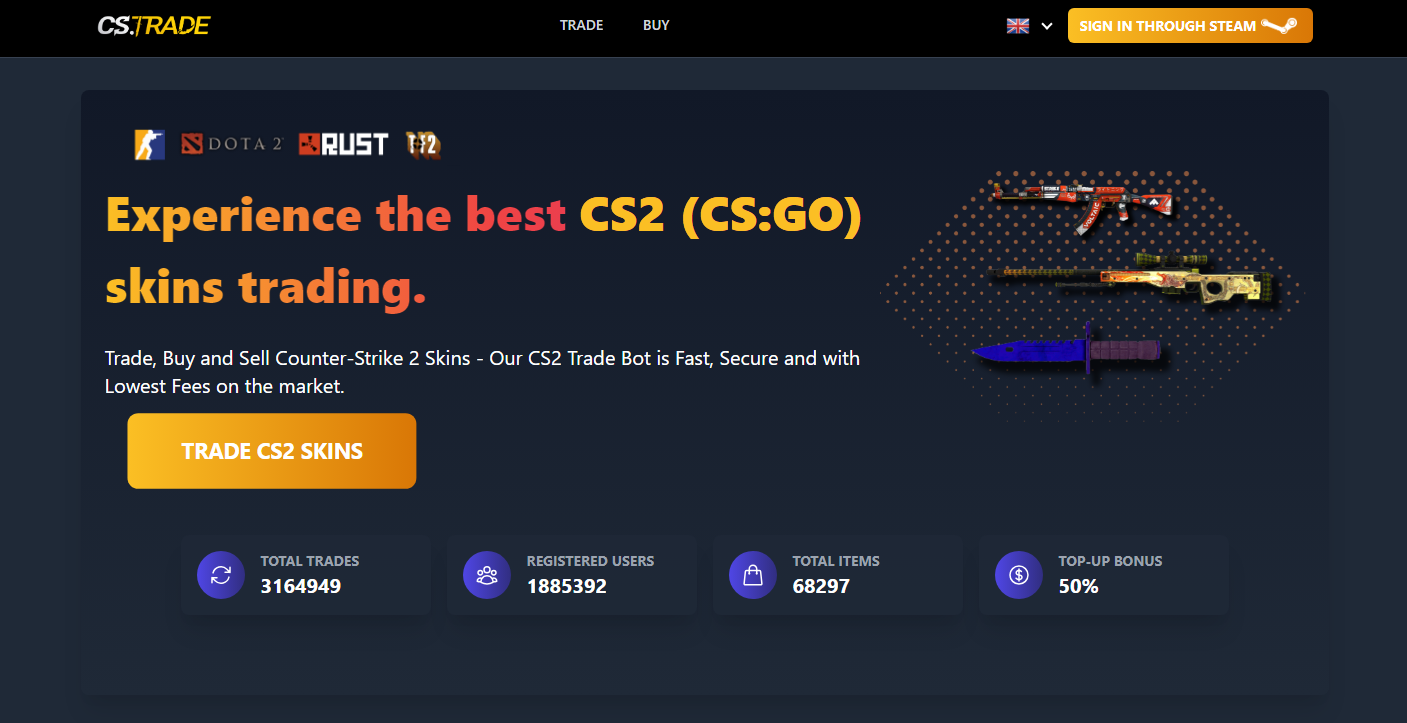

CS2 Trade Bots: Your New Best Friend or Foe on the Market?

Discover if CS2 trade bots are your ultimate ally or your biggest enemy in the market—uncover the truth now!

How CS2 Trade Bots Work: A Comprehensive Guide

CS2 trade bots have become increasingly prevalent in the gaming community, particularly among players of Counter-Strike 2 (CS2). These bots are automated programs designed to facilitate the trading of in-game items, enhancing the overall trading experience. Typically, they operate by scanning available inventory items, assessing their market value through algorithms, and finding suitable trades with other users. This can significantly reduce the time and effort required for trading while ensuring fair value for both parties involved.

The functioning of CS2 trade bots can be broken down into several key steps:

- Inventory Management: The bot continuously monitors the user's inventory for potential items to trade.

- Market Analysis: It uses algorithms to evaluate the current market trends and item values.

- Trade Matching: The bot identifies and proposes trades with other players based on mutual interests.

- Transaction Execution: Once both parties agree to a trade, the bot manages the transaction process, ensuring everything is completed securely.

Counter-Strike, a popular tactical first-person shooter, has captivated gamers since its inception. Players engage in intense multiplayer matches, focusing on teamwork and strategy. To enhance gameplay, many players seek out CS2 Cases for unique skins and upgrades that personalize their experience.

Top 5 Advantages and Disadvantages of Using CS2 Trade Bots

In the realm of trading, especially in the competitive world of CS2, leveraging trade bots can significantly streamline decision-making and execution. Here are the top five advantages:

- 24/7 Trading: Unlike human traders, trade bots can operate around the clock without fatigue, seizing trading opportunities any time they arise.

- Speed and Efficiency: Trade bots can analyze market conditions and execute trades in milliseconds, making them far quicker than any manual trading approach.

- Emotion-Free Trading: By relying on algorithms, trade bots eliminate emotional decision-making, which can often lead to poor trading outcomes.

- Backtesting Capabilities: Many trade bots allow users to backtest strategies using historical data, enabling traders to refine their strategies before risking real capital.

- Consistent Strategies: Trade bots ensure that the trading strategies are implemented consistently, reducing the chances of deviation caused by market volatility.

However, employing CS2 trade bots also comes with its downsides. Below are the top five disadvantages:

- Technical Issues: Like any software, trade bots can experience glitches or server downtime, which can lead to missed opportunities or financial losses.

- Market Changes: Algorithms may struggle to adapt to sudden changes in market conditions, potentially leading to suboptimal trades.

- Costs: While some trade bots are free, many charge subscription fees or take a percentage of profits, which can eat into overall earnings.

- Dependency on Technology: Over-reliance on bots can diminish a trader's own analytical skills, making them less adept at manual trading.

- Security Risks: Using trade bots requires sharing access to trading accounts, which may expose users to potential hacks or unauthorized trading activities.

Are CS2 Trade Bots the Future of Trading or Just a Fad?

The emergence of CS2 trade bots has sparked a heated debate in the online trading community. Advocates argue that these advanced algorithms can execute trades with unparalleled speed and efficiency, potentially transforming the way we engage with markets. With the ability to process vast amounts of data and react to market changes in real-time, CS2 trade bots may offer a path to consistent profits that manual traders can struggle to achieve. Additionally, the automation provided by these bots allows traders to focus on strategy and analysis rather than getting bogged down in the minutiae of day-to-day trading.

However, skeptics remind us that the trading landscape is notorious for its cyclical nature. Trends can rapidly shift, and what works exceptionally well today might become obsolete tomorrow. While CS2 trade bots offer impressive features, they also come with risks, including potential over-reliance on technology and market conditions that can lead to significant losses. Ultimately, whether these bots are the future of trading or just a transient trend remains to be seen, but their impact on how we trade warrants serious consideration.